Accounting is the language of business. Every company, from a local coffee shop to a Fortune 500 giant, runs on it. It tells the story of how money moves, what decisions pay off, and where improvement is needed. Understanding the fundamentals of accounting isn’t just for accountants — it’s for anyone who wants to make smarter business decisions.

Whether you’re an entrepreneur, a manager, or a student preparing for your career, mastering the fundamentals of accounting means mastering financial clarity. It allows you to analyze performance, control costs, and communicate confidently about money.

Let’s break down the key principles, concepts, and statements that make up accounting’s foundation, and explore how you can build real fluency step by step.

1. What Are the Fundamentals of Accounting?

At its core, accounting is a structured way of recording, organizing, and interpreting financial information. Every sale, purchase, or expense a business makes is tracked through the accounting system to create a clear record of what’s happening financially.

The fundamentals of accounting are built on a few simple ideas that never change, no matter the size or type of business. These are known as accounting principles — the rules that ensure accuracy, transparency, and comparability across financial reports.

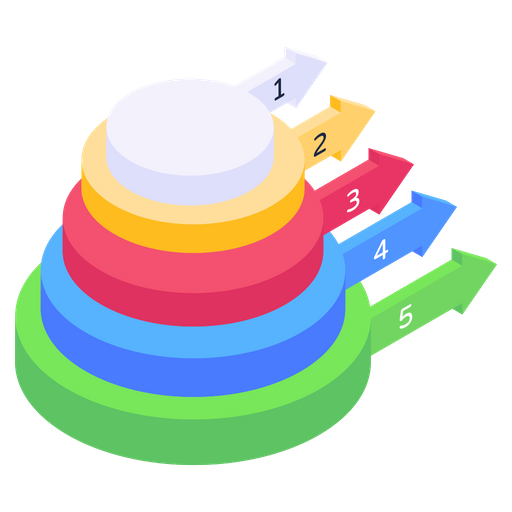

The Five Key Accounting Principles

1. Revenue Recognition Principle: Record revenue when it’s earned, not necessarily when cash is received.

2. Cost Principle: Assets are recorded at their original cost, not their current market value.

3. Matching Principle: Expenses should be recorded in the same period as the revenues they help generate.

4. Full Disclosure Principle: Businesses must disclose all relevant financial information that might affect users’ decisions.

5. Objectivity Principle: All accounting entries should be based on verifiable, unbiased evidence. These principles form the ethical and practical backbone of financial accounting, ensuring every company’s reports can be trusted and understood.

2. The Accounting Equation: The Foundation of Everything

The accounting equation is the bedrock of all accounting systems:

Assets = Liabilities + Owners' Equity

It’s more than a formula — it’s a philosophy. It tells us that everything a company owns (assets) is financed either by borrowing money (liabilities) or by the owners' investment (equity).

This simple balance drives the structure of every balance sheet and underpins the concept of double-entry accounting.

3. Double-Entry Accounting: Keeping Everything in Balance

Every transaction in accounting affects at least two accounts. This system is known as double-entry accounting, and it keeps the books balanced at all times.

Here’s an example:

• You buy office supplies with $500 cash.

• Debit: Supplies (Asset +$500)

• Credit: Cash (Asset -$500)

The equation remains balanced. One account goes up, another goes down, and the financial story stays accurate.

Without this system, financial statements would quickly lose integrity — and errors would go unnoticed.

4. Recording Transactions: The Day-to-Day Work of Accounting

Recording business activity is the heartbeat of accounting. This process includes creating journal entries, updating the general ledger, and summarizing information into the trial balance — the precursor to financial statements.

Each transaction should include:

• The date

• The accounts affected

• Debits and credits

• A short description or memo

Accurate transaction recording ensures every financial statement reflects reality. From accounts payable (money you owe) to accounts receivable (money owed to you), these records keep the business accountable.

5. The Three Core Financial Statements

Once all transactions are recorded, accountants summarize them into reports that tell the story of a company’s performance and position. These are known as the financial statements, and they form the heart of financial accounting.

The Balance Sheet

The balance sheet shows a company’s financial position at a specific point in time. It lists:

• Assets (what the company owns)

• Liabilities (what it owes)

• Equity (what belongs to owners after debts are paid)

It’s a snapshot of financial health. If assets grow faster than liabilities, the business is on solid ground. If debts rise faster than equity, that’s a warning sign.

The Income Statement

Also called the profit and loss statement, this report shows how much revenue the company earned and how much it incurred in expenses over a specific period. It answers the question: Did we make money?

Here you’ll find revenues, expenses, and net income — the ultimate measure of profitability. Every number on this statement tells part of the story of performance and efficiency.

The Cash Flow Statement

Cash flow is where financial reality meets the bank account. This statement tracks how money moves through the business:

• Operating activities: day-to-day business

• Investing activities: buying or selling long-term assets

• Financing activities: borrowing, repaying, or issuing equity

Even profitable businesses can fail if they run out of cash. The cash flow statement shows whether a company can sustain operations and fund growth.

Together, these three statements reveal everything you need to assess a company’s financial health.

6. Financial Accounting vs. Managerial Accounting

While financial accounting focuses on creating reports for external stakeholders (investors, creditors, regulators), managerial accounting is about helping internal leaders make better decisions.

Here’s the difference:

• Financial Accounting: Emphasizes accuracy, compliance, and standardized reporting (e.g., GAAP or IFRS).

• Managerial Accounting: Focuses on analysis, forecasting, and performance improvement for management use.

Both share the same foundation—the fundamentals of accounting—but they serve different purposes. Together, they provide the complete picture: what happened, why it happened, and what to do next.

7. Why Understanding the Fundamentals Matters

Learning the fundamentals of accounting empowers you to:

• Speak confidently about money and financial statements

• Detect red flags early, like poor cash flow or excessive debt

• Make data-driven decisions rather than emotional ones

• Build credibility with investors and lenders

• Understand how your daily business activities impact long-term results

When you can read and interpret financial statements, you stop guessing and start seeing your business the way CFOs and analysts do — through numbers that tell the truth.

8. Common Mistakes Beginners Make

Even with good intentions, beginners often fall into avoidable traps. Here are some of the most common:

1. Recording revenue at the wrong time — ignoring the revenue recognition principle.

2. Misclassifying expenses and assets — confusing short-term costs with long-term investments.

3. Neglecting accounts payable — failing to track obligations accurately.

4. Forgetting accrual adjustments — causing profits to look better or worse than they are.

5. Not reconciling accounts — allowing small errors to grow into major discrepancies.

Accuracy in accounting is about discipline. Every entry, adjustment, and cross-check matters.

9. How to Strengthen Your Accounting Foundation

The best way to learn accounting isn’t by reading definitions — it’s by doing.

Here’s how to master the fundamentals faster:

• Start small and build confidence. Learn the definitions of basic terms before diving into complex financial statements.

• Study a little every day. Fifteen minutes of consistent practice beats a single cram session.

• Connect theory to real business examples. Look at real income statements and balance sheets to see how companies tell their financial stories.

• Use tools designed for learning.

Ledgeroo lets you learn accounting online in a fun, interactive way. With bite-sized lessons, instant feedback, and gamified challenges, you’ll build mastery step-by-step.

In Ledgeroo’s world, you’re not just memorizing terms — you’re solving problems, making decisions, and watching your skills compound like interest.

10. Accounting in the Real World

Once you understand the fundamentals, you start to see accounting everywhere:

• In your personal finances, balancing your bank account mirrors the balance sheet.

• In business, analyzing income statements reveals what’s driving profit or loss.

• In investing, financial statements become a roadmap to spotting undervalued companies.

Every business function—from HR to engineering—benefits from employees who understand accounting. It bridges communication between departments and drives smarter strategy across the board.

11. The Path to Mastery

Learning the fundamentals of accounting is the first step toward financial fluency. From here, you can branch into:

• Intermediate Accounting: Deeper exploration of complex transactions and adjustments.

• Managerial Accounting: Budgeting, cost analysis, and decision-making tools.

• Corporate Finance: How financial statements tie into valuation and capital strategy.

• Auditing: Testing accuracy and compliance.

But the journey always starts with fundamentals — the building blocks that never change.

Make Accounting Your Superpower

The fundamentals of accounting are more than technical rules — they’re the keys to understanding how money really moves. Once you grasp how transactions connect to financial statements and what those statements reveal about performance, you unlock a new level of insight.

Accounting isn’t just about compliance. It’s about control. It’s about seeing the truth behind the numbers and making decisions from a position of strength.

Ready to take the next step?

Start learning with Ledgeroo, where accounting meets gamification. In just 5 minutes a day, you can strengthen your understanding, test your knowledge, and master the language of business—one lesson at a time. Because when you understand accounting, you don’t just track the game. You play to win.

November 28, 2025

Master the Fundamentals of Accounting with Ledgeroo

At Ledgeroo, we believe that everyone working in business—regardless of the role—should have a solid understanding of the fundamentals of accounting.